This article is part two of The ESG Communications Playbook, a four-part series on engaging and converting prospective ESG investors.

Getting to Work: AMPing and Investor Funnels

The ESG investment boom has impacted three of Antenna Group’s practice areas: clean energy and sustainability tech, mobility and real estate. Many of our clients have raised questions around how to best position their organization and attract investors looking to fund organizations like theirs. These companies include innovators in energy storage, demand response, clean energy generation, electric vehicle charging, sustainable building and smart cities — all of which fit the ESG investment thesis and criteria.

This section of our ESG series focuses on a tactical approach for capital-seeking organizations to target financial institution influencers and decision makers with differentiated messaging. We call the process AMPing: Audience, Message, Platform. A foundational AMPing Plan is the first step in building an Investor Funnel — the investor relations equivalent of a sales funnel (don’t worry about the jargon right now, it will all be explained below).

With this plan in place, organizations can build an investor funnel that will attract, nurture and convert ESG investors into a capital (or debt) investment in your company.

Audience Identification

We have frequently been approached by companies with an innovative, disruptive product that can’t seem to get sales traction. Often, the underlying cause is a lack of clarity as to who the buyer is. Surprising, perhaps, but it is a common reality.

Any marketing or public relations activity will be doomed without a clearly defined audience and segmentation strategy. Even the best content can fall flat if it isn’t customized to a specific persona. For instance, a Chief Facilities Officer at a manufacturing company will likely be uninterested in a blog post that demystifies the science behind Lithium-ion batteries (no matter how clever). Instead, send them an e-book about the resiliency impact of those same batteries and you have the beginning of a dialogue.

Step One of identifying and segmenting audiences is utilizing the people in your organization who are on the front lines of this process: your salespeople. Your sales team has the most insight into audience engagement, but their intel can be lost if they’re excluded from marketing meetings. When onboarding a new account, the Antenna Group team insists on interviewing a wide swath of organizational stakeholders, including salespeople, in order to gain a keen understanding of audiences and messaging.

In addition to salespeople, we advise our clients to lean heavily on LinkedIn as it offers rich audience identification and segmentation functionalities. Since most organizations have multiple stakeholders (e.g. customers, prospects, investors, employees, influencers, etc.), it is critical to nail down audiences before moving on to the next step of messaging.

Messaging

This is the bottom line when it comes to ESG communications. Companies that take ownership of their ESG narrative and integrate these topics into their investment story have one of the most important brand storytelling opportunities of this decade. It is an incalculable mistake to forgo telling this story; especially when you can be certain that your competitor is telling theirs.

At a minimum, your message should clearly articulate how strong corporate responsibility practices are creating business value. Investor relations 101 demands that investors understand your business value. So by extension, ESG investors will be motivated to invest in your organization if they understand how a commitment to excellent ESG performance is benefitting your business. As George Serafeim pointed out in a recent HBR article, too many companies have embraced a “box-ticking” approach to ESG activities. While those activities may well be good for society and the bottom line, they are now table stakes and are often not enough.

Sustainability is a competitive advantage for those who have made it central to their corporate DNA. As such, these companies should publicly set authentic ambitions (aka a bold north star), innovate for scale and remain transparent. Mission statements should be articulated clearly and disseminated widely.

An “ESG Accomplishments” section on your website is nice, but easily overlooked. Your brand’s commitment to ESG must be articulated clearly and address the why (“Why is it important?”), when (“Are you a Johnny Come Lately?”), and where (“Where in your business is the ESG commitment reflected?”). This narrative should be distinct from those of your competitive set.

Messaging is a market signal. Once that signal is sent, your organization will be held accountable. Be sure to establish measurable goals and benchmarks. Announce milestones when they are achieved.

Platform

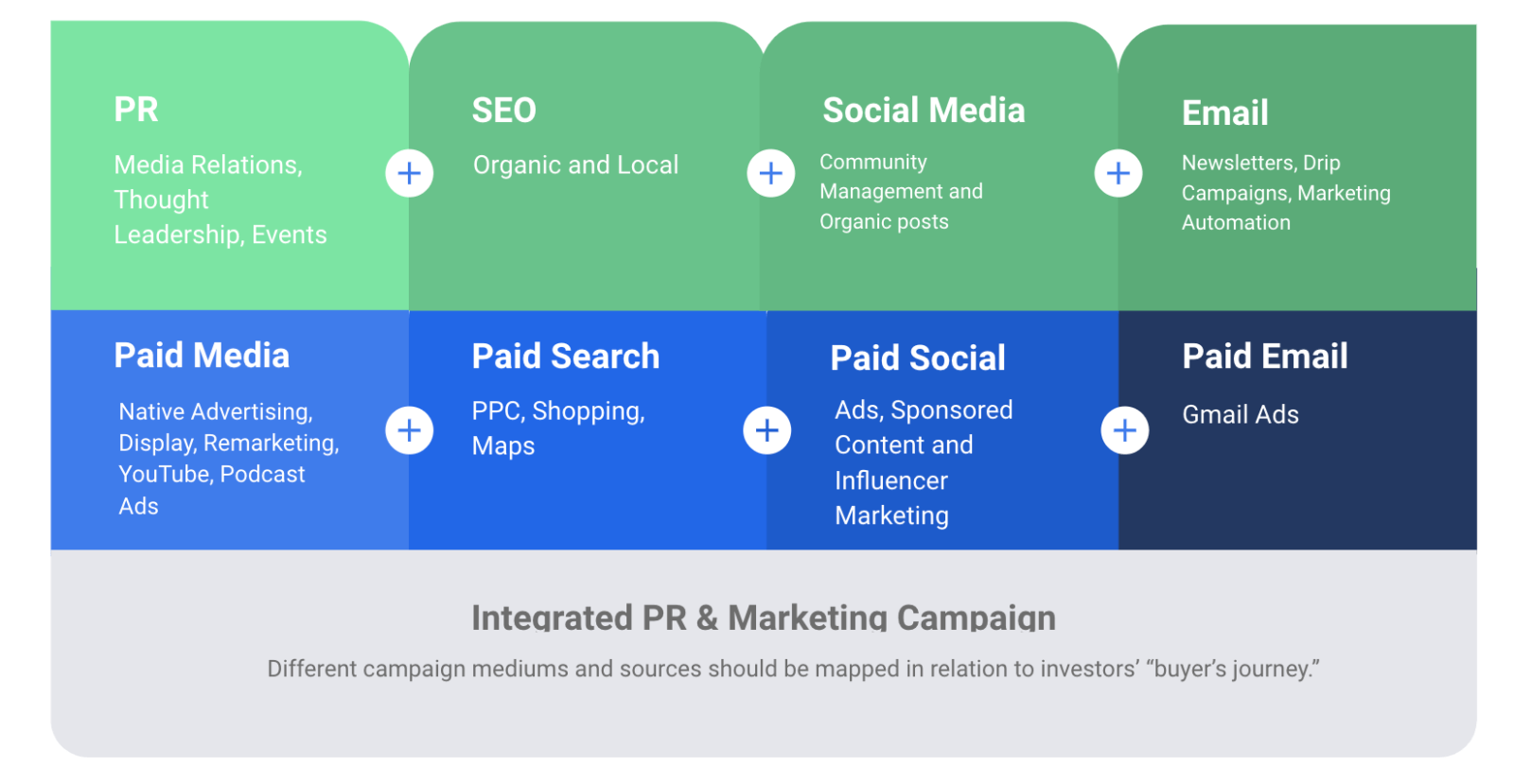

Marketing was simpler twenty years ago! Today, there are dozens of communications channels and platforms from which to choose. Many of them enable businesses to micro-target segmented audiences in a manner that is cost effective.

This is not to say that traditional communications platforms are irrelevant. In fact, they are more relevant than ever. The difference is that they need to be utilized in conjunction with a tactically sophisticated digital and social marketing strategy to reap their full potential.

How does one choose the right platform(s) for their ESG marketing efforts? Simply put, choosing a platform is an exercise in matching your audience to the platform(s) they engage with.

What are these platforms? To name just a sampling:

- Newspapers, magazines and broadcast media (traditional PR)

- Trade shows and conferences (Events)

- Social platforms such as LinkedIn, Facebook and Twitter (Social)

- Google search and digital ads (Paid Media)

- Podcasts, blogs and corporate website (SEO)

The value of each platform is varied but accretive so that the whole of an integrated campaign is greater than the sum of its parts. For example, traditional media coverage yields a high level of credibility. It is a third party endorsement that creates a halo effect for your brand. The downside of traditional media is that it’s difficult to measure the impact and reach. However, when combined with a LinkedIn campaign, the media placement is transformed into content that is both highly targeted and measurable.

Each of the above platforms can be further distilled based on the particular interest of your target audiences. Most business professionals engage with three types of platforms: 1.) platforms that are addressed to the wider business community; 2.) platforms that are addressed to their specific industry; 3.) Platforms that are addressed to their specific business role.

For example, a VP of Sales at an energy management SAAS solutions company will typically be responsive to content from: 1.) Business publications and platforms; 2.) SAAS publications and platforms; 3.) Sales publications and platforms. An ESG company that is targeting this individual should prioritize coverage in relevant traditional publications, attend the right trade shows, build a presence on the appropriate social networks (in this circumstance it would be LinkedIn), execute an effective SEO campaign, and create personalized, relevant content.

The best ESG messages can be lost if they aren’t distributed to the right audience, with a message that resonates, on a platform that they interact with. AMPing your ESG marketing strategy will ensure that your presence on the playing field is profound and profitable.